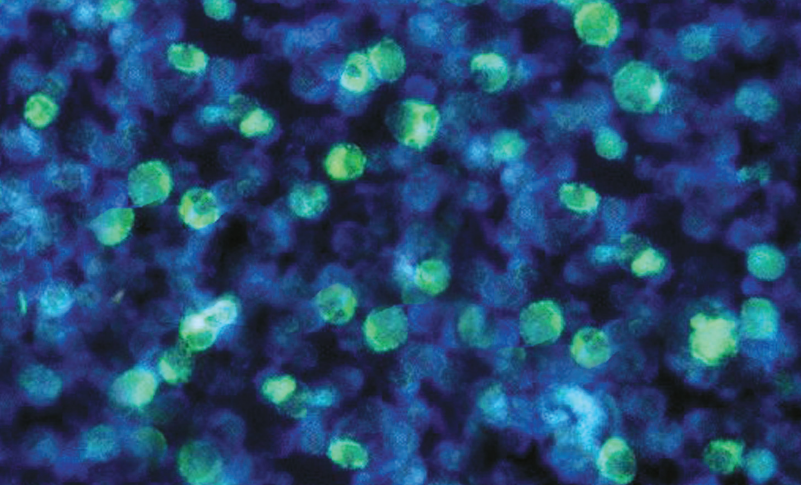

Biocon Biologics has one of the deepest portfolios of biosimilars in the industry, spanning across insulin, monoclonal antibodies and conjugated recombinant proteins. Our long-term investments in R&D have yielded several molecules in diabetes, oncology, and immunology of which eight have been already commercialized in markets globally.

We were the first company to receive U.S. FDA approval for biosimilar Trastuzumab and biosimilar Pegfilgrastim.

The commercial success of our biosimilar versions of Pegfilgrastim, Trastuzumab and Insulin Glargine and in-licensed biosimilars, Adalimumab and Etanercept, has allowed us to continue to invest in our pipeline.

We have built a sizeable portfolio of unpartnered biosimilars that are at various stages of development and also advanced biosimilar Denosumab into clinical development.

Our portfolio also includes biosimilar Pertuzumab, biosimilar Insulin Glargine 300U and several other early stage undisclosed programs, which would sustain our growth in the long-term.