Business Highlights

GENERICS: APIs & Generic Formulations

- Q4FY24 Revenue at Rs 719 Crore, down 3% YoY

- FY24 Revenue at Rs 2,799 Crore, up 1%

Business Performance

The Generics business saw several operational successes during the quarter especially in the formulations business which offset the impact of a muted performance in the APIs business. Revenue stood at Rs 719 crore for the quarter and Rs 2,799 crore for the full year.

Biocon became the first company to receive approval from the MHRA, UK, for its vertically integrated, complex formulation Liraglutide (gVictoza® and gSaxenda®). Victoza®@ is a drug device combination formulation used in the treatment of Type 2 diabetes, and Saxenda®@ is an injection in pre-filled pen, for the treatment of weight management, as an adjunct to a reduced calorie diet and increased physical activity.

The Company launched Liothyronine Sodium tablets, an in-licensed product, in strengths of 5 mcg, 25 mcg and 50 mcg, in the U.S. Liothyronine is used in the treatment of hypothyroidism, pituitary thyroid-stimulating hormone (tsh) suppression and thyroid suppression tests.

In April 2024, the Company also received its first approval in South Africa, from the SAPHRA, for its vertically integrated, complex immunosuppressant product, Tacrolimus capsule, used in the treatment of organ transplant patients.

The Company entered into two important commercial agreements. In April 2024, it signed an exclusive licensing and supply agreement with Biomm S.A. for the commercialization of Semaglutide (gOzempic®@) in Brazil. Biocon will develop, manufacture, and supply the drug product, and Biomm will commercialize it in the region, post obtaining regulatory approval. Semaglutide is used in the treatment of Type 2 diabetes of adults, to improve glycemic control.

In May 2024, the Company signed a semi-exclusive distribution and supply agreement with Medix, a specialty pharmaceutical company in Mexico, for the commercialization of its vertically integrated drug product, Liraglutide (gSaxenda®), used in the treatment of chronic weight management.

In line with its regional expansion strategy, tenders were won in several markets, such as the U.K., Scotland, Singapore, and Saudi Arabia.

The Company received approvals for Rosuvastatin tablets in Malaysia and Lenalidomide capsules in Singapore.

There is a sustained momentum being built up in the formulations business driven by new product launches, strengthening of the U.S. business footprint and further traction in business expansion through both direct-to- market and strategic partnership models.

Regulatory Inspections

Biocon Limited received GMP certificates from the Brazilian Health Authority, ANVISA, for two products from its API facility at Visakhapatnam (site 5) in March 2024, and in April 2024 for one product from its Bengaluru API facility (site 1). ANVISA also concluded an audit at its Hyderabad API facility (site 3), for 13 products, with no observations.

@Victoza®, Saxenda® and Ozempic® are registered trademarks of Novo Nordisk A/S.

NOVEL BIOLOGICS

The novel molecule, Itolizumab, continues to make progress. On April 1, 2024, Equillium, Biocon’s U.S.-based partner, announced positive topline data from a Phase 1b EQUALISE study of Itolizumab in patients with Lupus Nephritis. The study demonstrated clinically meaningful response in highly proteinuric subjects, with more than 80% of subjects achieving over 50% reduction in urine protein creatinine ratio. Itolizumab demonstrated a favorable safety and tolerability profile.

In FY24, the Company recorded a gain of Rs 530 crore, arising from the dilution of Biocon’s shareholding in Bicara to 14%, leading to loss of significant influence over Bicara. Henceforth, it is no longer an ‘associate company’ of the Biocon Group.

BIOSIMILARS: Biocon Biologics Limited (BBL)

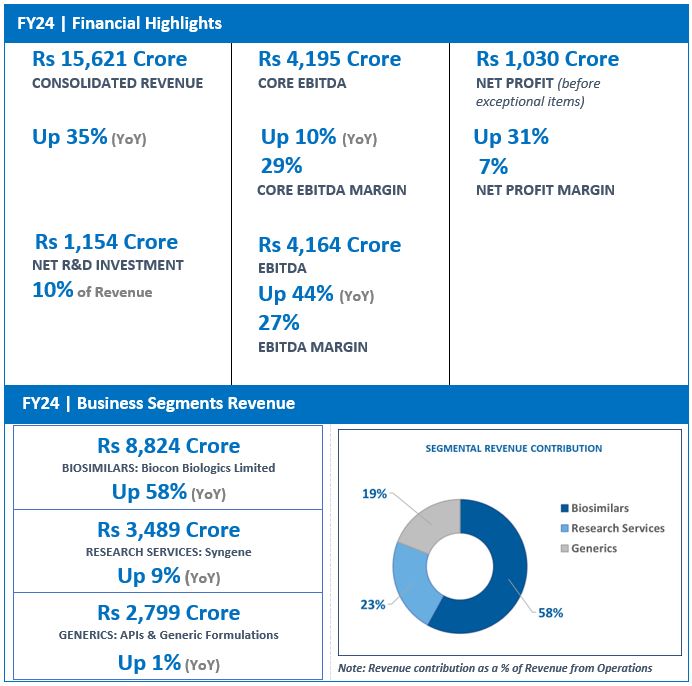

- FY24 Revenue crosses USD 1 Billion; up 58% at Rs 8,824 Crore

- Q4FY24 Revenue at Rs 2,358 Crore, up 12% YoY

- Served ~5.5 million patients (MAT March 2024 basis)##

##12-month moving annual patient population (April 2023 to March 2024)

Business Performance

Q4FY24

Biocon Biologics reported a YoY growth of 12% for Q4FY24 with revenue at Rs 2,358 crore.

Core EBITDA stood at Rs 698 crore, with Core EBITDA margin at 30%. EBITDA margins for the quarter were a healthy 24%.

Financial Year FY24

On a full-year basis, Biocon Biologics crossed the USD 1 billion annual revenue mark in FY24, with revenue at Rs 8,824 crore, reflecting a 58% year-on-year growth driven by the consolidation of the acquired business and robust growth in the core business across advanced and emerging markets.

Core EBITDA grew by 11% to Rs 2,458 crore. EBITDA for the year stood at Rs 2,190 crore, reporting a year-on-year growth of 64% with a margin of 25%. The Company continued to invest in its pipeline to drive future growth with R&D investments at 10% of its revenue.

North America@

In the U.S. market, Biocon Biologics is benefiting from the integration of the acquired business, as evidenced by its performance in Q4FY24. With Biocon Biologics now spearheading commercial operations, the Company witnessed a significant step up in the market shares of its biosimilars in the U.S. The market share for Ogivri® (bTrastuzumab) increased to 18% from 10% in the same period last year. Biocon Biologics also secured four new commercial formulary agreements for Ogivri®, including UnitedHealthcare® Commercial Medical Benefit Drug Policy, effective May 1, 2024, as a UnitedHealthcare Preferred Oncology Product. The share of Fulphila® (bPegfilgrastim) increased to 21% from 14% a year ago. Fulphila® is the only brand in its category to expand its market share.

Semglee® and our unbranded bGlargine market share improved to 15% from 12% the previous year, with Semglee® becoming the fastest growing brand in the basal insulins category in the U.S. in the quarter. In addition, unbranded bGlargine holds a strong market share with a closed-door pharmacy network which would add an additional 3% market share.

The U.S. FDA has accepted Biocon Biologics’ Biologics License Application (BLA) for Bmab 1200 (bUstekinumab) for review under the 351(k) pathway. The Company has signed a settlement and license agreement with Janssen Biotech Inc. and Johnson & Johnson that clears the way to commercialize Bmab 1200, Biocon Biologics’ proposed biosimilar referencing Stelara®**(Ustekinumab), subject to regulatory approval, in the U.S. no later than February 22, 2025. This will position Biocon Biologics among the first wave of entrants in the U.S. for bUstekinumab.

In Canada, the Company maintained a steady position across all products. Hulio® (bAdalimumab) market share increased to 7.5% from 6% a year ago. Biocon Biologics has also secured a contract to supply bGlargine to the country’s largest retail outlet.

The Company also signed a settlement agreement with Bayer Inc. and Regeneron Pharmaceuticals Inc. for the launch of YESAFILI®, a proposed biosimilar to EYLEA®*** (Aflibercept injection) in Canada no later than July 1, 2025. The product has already been approved by Health Canada.

Europe and JANZ&

The Company achieved double-digit year-on-year revenue growth in both Europe and the markets of Japan, Australia, and New Zealand (JANZ). Biocon Biologics has successfully integrated all 31 countries in Europe by strategically adopting country-specific business models that include self-led markets with dedicated teams and some partner-led markets.

In Europe overall, market shares improved from the previous year, with Fulphila® at ~8% vs ~6% (Q4 CY ’22) and Abevmy® at ~6% vs ~1% (Q4 CY ’22). Hulio® has held its share at ~6%. At a country level, Hulio ® has garnered market shares of 20% in Belgium, 18% in Germany and 11% in France and continues to remain a key value and growth contributor.*

The Company has successfully integrated the acquired business in JANZ markets and signed on partners, establishing a foundation to gain from market opportunities and sustain growth.

@ North America: Market shares based on IQVIA March 2024 data.

& Europe & JANZ: Market shares based on IQVIA Q4 CY2023 data.

**Stelara® is a registered trademark of Johnson & Johnson.

*** EYLEA® is a registered trademark of Regeneron Pharmaceuticals Inc.

Emerging Markets

In Q4FY24, the Emerging Markets business posted the highest ever quarterly revenue reporting a strong year-on-year growth led by the robust performance of its biosimilars portfolio in LATAM, AFMET and APAC regions. This performance was driven by the consolidation of self-led and partner- led business, 7 product launches and key tender wins.

Notable highlights included good uptake of bBevacizumab in Brazil and successful launches in several other markets in LATAM. The Company also expanded its patients’ reach in Mexico with additional supplies of insulins to its partner to address the unmet needs of insulin-dependent people grappling with the market shortage of insulins.

Both the insulins and monoclonal antibodies (mAbs) portfolios made good progress with our key products holding a dominant market share in several markets including Morocco, South Africa, and the Philippines.

The Company also capitalized on the opportunity to serve patients in new markets by winning many tenders this quarter, including a significantly large multi-year tender for mAbs in Tunisia. Several new approvals obtained this quarter will pave the way for future business growth.

Biocon Biologics has expanded its strategic collaboration with Eris Lifesciences, to provide access to its portfolio of Metabolics, Oncology and Critical Care brands in India, for a total transaction value of INR 1,242 crore^, which represents a revenue multiple of 3.4x and EBITDA multiple of 18x. This strategic collaboration with Eris aligns with Biocon Biologics’ commercial strategy to maximize patient reach and market potential, while unlocking value from its branded formulations business in India. The Company has also signed a 10-year supply agreement with Eris for these products as a part of this collaboration.

^INR 1,242 crore is not included in Q4FY24 earnings

RESEARCH SERVICES: Syngene

- Q4FY24 Revenue at Rs 917 Crore, down 8% YoY

- FY24 Revenue at Rs 3,489 Crore, up 9%

Business Performance

Revenue at Rs 917 crore in Q4FY24 was impacted due to reduced demand for research and development services within U.S. biotech stemming from a difficult funding environment. The company continued to manage costs proactively to deliver consistent operating leverage and maintain EBITDA margin around the expected level. During the quarter, it operationalized a new capability for purifying and separating chiral compounds and HPAPIs (Highly Potent Active Pharmaceutical Ingredients) as part of its Development Services.

The recent step up in new funding into U.S. biotech is expected to drive a recovery in demand for research and development services.

During the year, Syngene continued to add capabilities that strengthen its position as a leading integrated provider of research, development and manufacturing services, resulting in full-year revenue growth of 9% to Rs 3,489 crore, EBITDA growth of 10% at Rs 1,105 crore with stable EBITDA margins of 31%.

Enclosed: Fact Sheet – with Financials as per IND-AS