BIOSIMILARS: Biocon Biologics

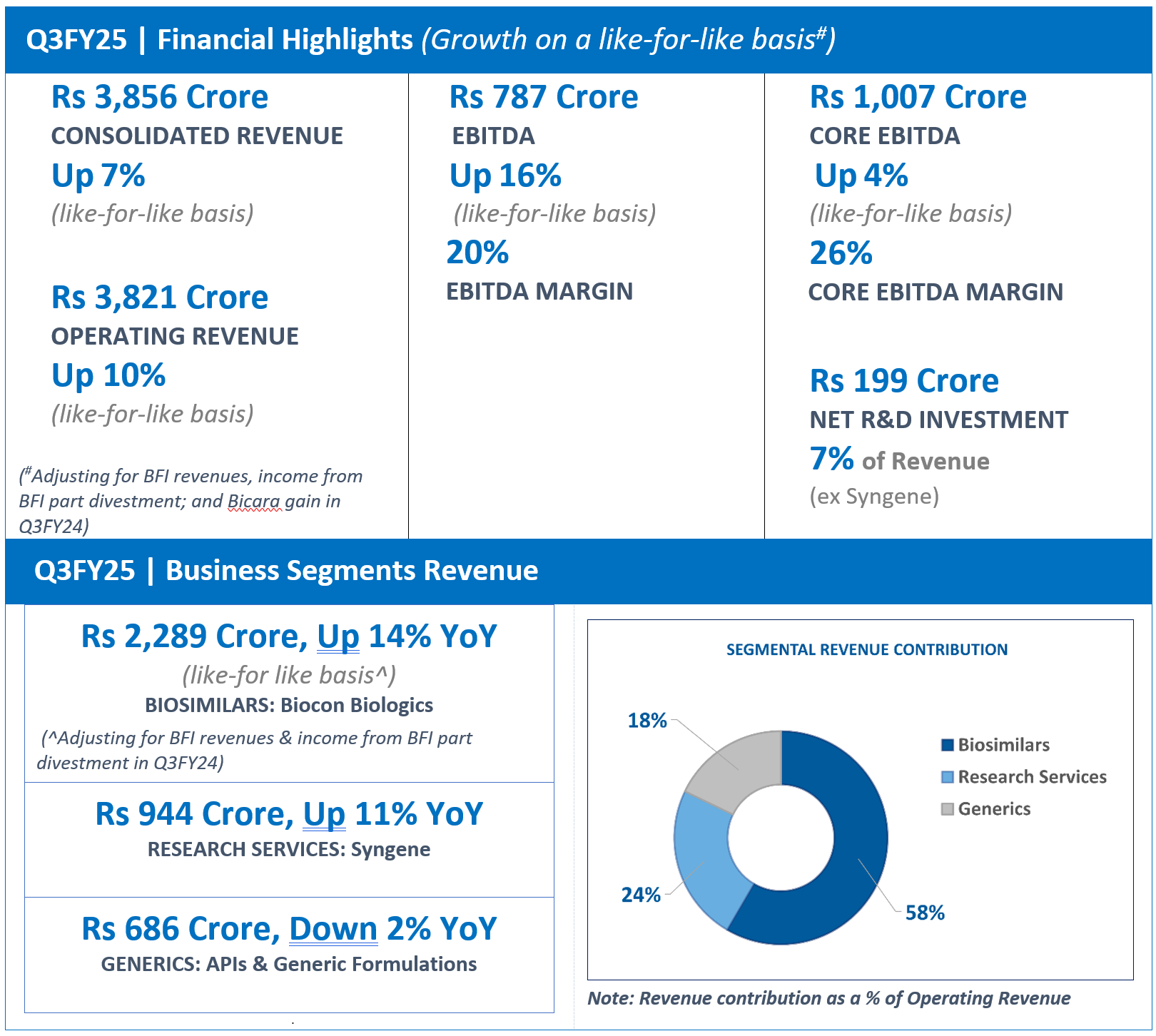

- Q3FY25 Revenue from Operations at Rs 2,289 Crore, Up 14% YoY on a like-for-like^ basis; Up 5% QoQ

- Q3FY25 EBITDA was Rs 487 crore; Up 44% YoY on a like-for-like^ basis

- Q3FY25 R&D Investments was Rs 135 crore, accounting for 6% of Revenue

- Served 5+ million patients (MAT December 2024 basis)##

^After adjusting Q3FY24 revenue for Branded Formulations India (BFI) revenue and income from part divestment of BFI business

##12-month moving annual patient population (January 2024 to December 2024)

Marking 1st Anniversary as an Integrated Global Biosimilars Company

Biocon Biologics marked the one-year milestone of completing the integration of the acquired business. Supported by a diverse, multicultural workforce spanning more than 25 nationalities, the Company has emerged as a fully integrated, global biosimilars company operating in over 120 countries.

Having successfully transformed from a two-country operation focused on Development and Manufacturing to an end-to-end biosimilars company with a strong Commercial engine. With this consolidation of business operations during 2024, Biocon Biologics has laid a strong foundation for accelerated business growth that will unlock value for the company and all its stakeholders.

Business Performance

Q3FY25

Biocon Biologics’ Q3FY25 Revenue from Operations at Rs 2,289 crore reported a YoY growth of 14% on a like-for-like basis after adjusting Q3FY24 revenue** for the Branded Formulations, India (BFI) revenue and income from part divestment of BFI business by the Company.

Reported EBITDA for Q3FY25 was Rs 487 crore, including a non-cash forex translation loss of Rs 20 crore. Excluding the forex impact, EBITDA margin for the quarter was 22%. On a like-for-like basis, EBITDA grew 44% YoY after adjusting for a Rs 350 crore gain in Q3FY24 from part divestment of the Branded Formulations (India) business, and BFI revenue.

Notes: **Q3FY24 Revenue included Branded Formulations India revenue and income from part divestment of Branded Formulations India business which are not a part of Q3FY25 revenue.

Final Remittances for Acquisition Completed

Biocon Biologics has fulfilled its obligations towards all deferred milestones under the acquisition agreement, which marks the full and final remittance of considerations from the Company towards Viatris for the acquisition.

Biocon Biologics’ balance sheet is reconfigured and its financials this quarter reflect a revised debt maturity profile after the completion of the strategic refinancing announced in October 2024.

Advanced Markets

North America@

Biocon Biologics continued to deliver a strong performance across its product portfolio in the U.S. The oncology franchise, comprising Ogivri® (bTrastuzumab) and Fulphila® (bPegfilgrastim), witnessed a significant increase in demand, with the market share for Ogivri® doubling to 22% from 11% last year, while the share for Fulphila® rose to 23% from 19% a year ago. The shares of the insulin franchise, which includes Semglee® and unbranded Insulin Glargine, continued to be in the mid-to-high teens, including all channels.

The Company received U.S. Food and Drug Administration (FDA) approval for YESINTEK™ (Ustekinumab-kfce), a biosimilar to the reference product, Stelara® (Ustekinumab) and is preparing for a February 2025 launch, which will strengthen its immunology portfolio in the U.S.

The U.S. FDA validated the Company’s Biologics License Application (BLA) filing for Denosumab, a biosimilar to the reference products Prolia® and XGEVA®, which has also been filed in several other geographies.

At the American Academy of Ophthalmology (AAO) 2024 Annual Meeting, the Company presented results of an extension of the pivotal Phase III study evaluating switching with MYL-1701P, a proposed biosimilar to Aflibercept. MYL-1701P showed promising results, demonstrating comparable safety, efficacy, and immunogenicity between patients continuing on MYL-1701P and those who switched from Aflibercept to MYL-1701P.

Europe and JANZ

In Europe, Biocon Biologics maintained stable market shares at a regional level with strong uptake in key markets such as Germany and France, where the Company holds double-digit shares for products such as Hulio® (bAdalimumab).

The Company received a Positive Opinion from the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP), which recommended the approval of YESINTEK® (bUstekinumab) for the treatment of adults and children with plaque psoriasis, as well as adults with psoriatic arthritis or Crohn’s disease.

The Company is beginning to see the results of its focus on both geographic and product expansion with sustained growth in the Mediterranean and UK-Nordics clusters. Biocon Biologics is also experiencing positive traction in the Japanese and Australian markets through its commercial partner.

In January, the Pharmaceuticals and Medical Devices Agency (PMDA) of Japan approved Ustekinumab BS subcutaneous injection [YD] through its partner. The biosimilar Ustekinumab has been developed and manufactured by Biocon Biologics and will be commercialized and marketed in Japan by the Company’s exclusive commercial partner, Yoshindo Inc.

@Market shares based on Biocon Biologics’ analysis of IQVIA Q3CY2024 data.

The data presented hereunder inter alia volumes, projections, market share, is based solely on our study, interpretation and conclusion derived through analysis of different data sets from varied sources inter alia IQVIA.

Emerging Markets

The Emerging Markets (EMs) business continues to expand the depth and breadth of its offering for patients through its portfolio of commercialized biosimilars. The Company further strengthened its Insulins franchise and witnessed strong demand for its key products, leading to market share expansion in both self-led and partner-led markets.

During the third quarter, 14 launches of key commercialized products were accomplished across regions, including bAdalimumab, bEtanercept, bAspart, bGlargine, bBevacizumab, and bPegfilgrastim in key countries of AFMET, LATAM and APAC regions. The Company won several tenders for its products, received 8 product approvals and continues to file new product applications across regions, which will pave the way for future growth.

Regulatory Inspections

Biocon Biologics’ multi-product manufacturing facilities in Bengaluru, India and insulins facilities in Johor, Malaysia have received Voluntary Action Indicated (VAI) classifications from the U.S. FDA in response to the inspections held earlier in July 2024 and September 2024, respectively. These critical U.S. FDA decisions will pave the way for new product approvals from these facilities and will enable the Company’s business further in the U.S.

Note: All trademarks, registered or unregistered, are the property of their respective owners.